THE TRUTH

ABOUT PROP HH

Proposition HH is tax increase that will end taxpayer refunds. It does NOT reduce property taxes.

Proposition HH in 40 seconds

An in-depth look at Proposition HH

What you need to know about Proposition HH.

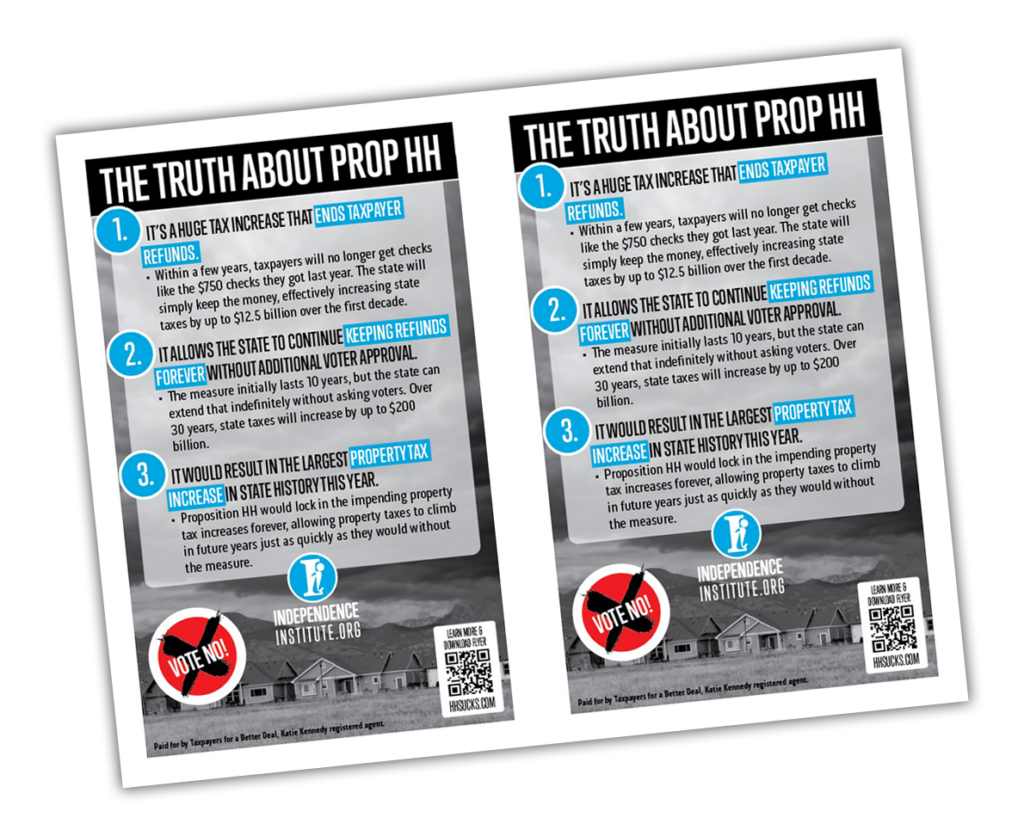

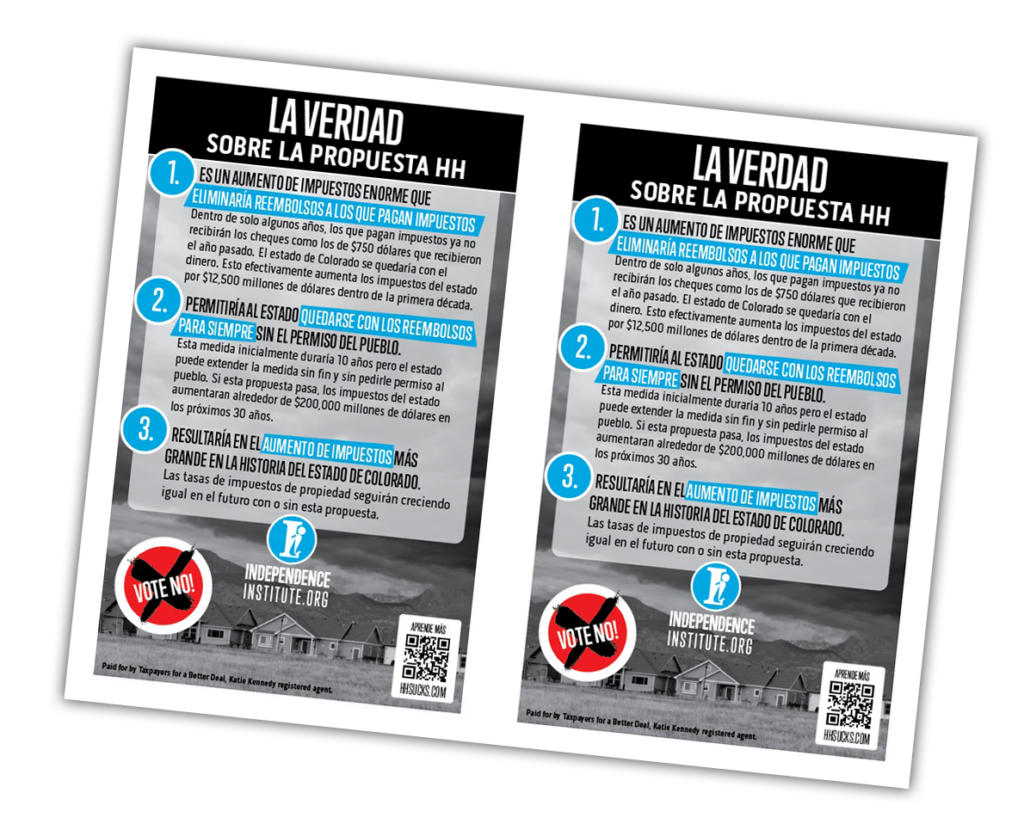

IT’S A HUGE TAX INCREASE THAT ENDS TAYPAYER REFUNDS

Within a few years, taxpayers will no longer get checks like the $750 checks they got last year. The state will simply keep the money, effectively increasing state taxes by up to $12.5 billion over the first decade..

IT ALLOWS THE STATE TO CONTINUE KEEPING REFUNDS FOREVER WITHOUT ADDITIONAL VOTER APPROVAL

The measure initially lasts 10 years, but the state can extend that indefinitely without asking voters. Over 30 years, state taxes will increase by up to $200 billion.

IT WOULD RESULT IN THE LARGEST PROPERTY TAX INCREASE IN STATE HISTORY THIS YEAR

Proposition HH would lock in the impending property tax increases forever, allowing property taxes to climb in future years just as quickly as they would without the measure.

A few of the MANY organizations opposed to Prop. HH

Vote “NO” on HH, it’s a bad deal.

- TAKES TABOR REFUNDS from taxpayers and gives them to the state, eliminating refunds entirely within a few years

- ALLOWS THE STATE TO COLLECT $12.5 BILLION IN NEW TAXES over the next decade, $65 billion over the next two decades, nearly $200 billion over the next three decades, and close to half a trillion dollars over the next four decades.

- Results in the LARGEST PROPERTY TAX INCREASE in state history, just slightly smaller than otherwise.*

- Lowers the residential assessment rate from 6.765% to 6.7%.

- Ensures PROPERTY TAXES WILL CONTINUE TO RISE at the same rate as property values after 2024.

- DOES NOTHING TO PREVENT SURGES IN PROPERTY TAXES in the future similar to what Coloradans face today.

- Permits the state to KEEP TABOR REFUNDS FOREVER without ever seeking additional voter approval so long as they keep these property tax provisions in place.

- Guarantees taxpayers will never get a better deal on property tax reform.

* In Douglas County, for example, property taxes would go up an average of 39% under HH, down from a 43% increase.

An In-depth Look at Prop HH

STAY UP-TO-DATE

Sign up for our email list and stay informed on all things Prop HH.